We are enclosing the forms and instructions for your premium payments to the Pension Benefit Guaranty Corporation for the 2005 plan year. You may file using these forms, or you may file electronically through PBGC's website. Electronic filing saves time and reduces the risk of errors. PBGC plans to require electronic filing of premiums, beginning with large plans in 2006. PBGC will provide guidance to filers in advance of that change.

PBGC's electronic filing system, called My Plan Administration Account (My PAA), enables you to exchange information with your service providers, notify each other of the next required action, track progress, file and pay, and receive payment confirmation from PBGC, all electronically. You will find detailed information about using My PAA on pages 43-46 of this Premium Payment Package. We invite you to try My PAA. On our home page, www.pbgc.gov, click on: Online Premium Filing (My PAA).

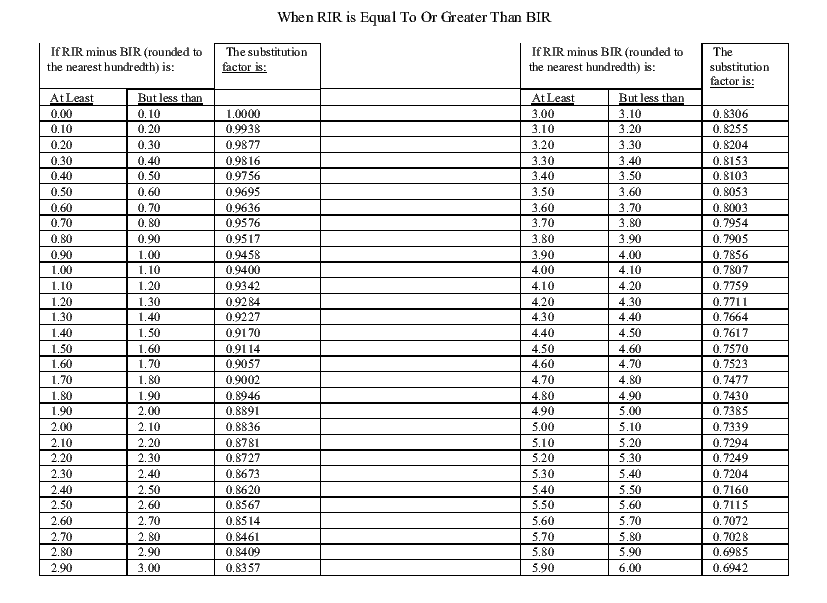

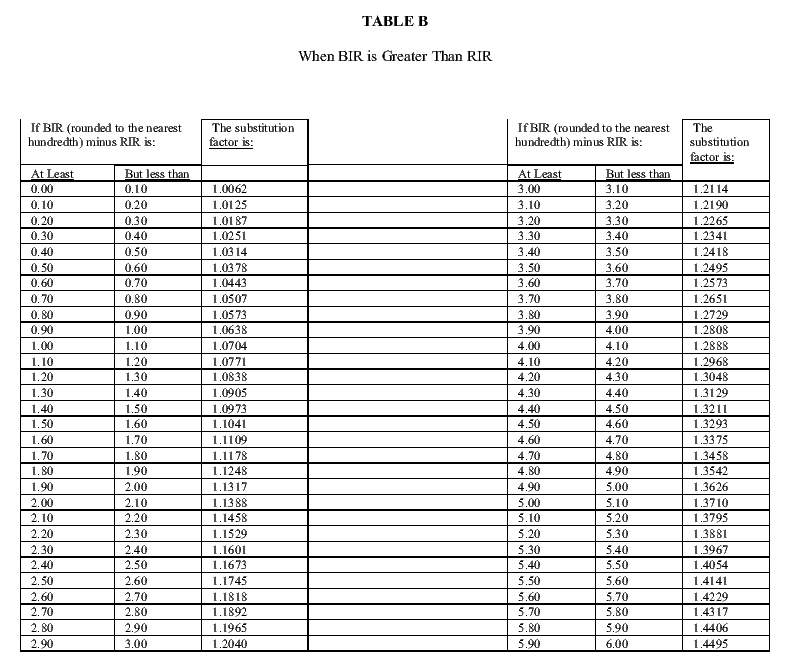

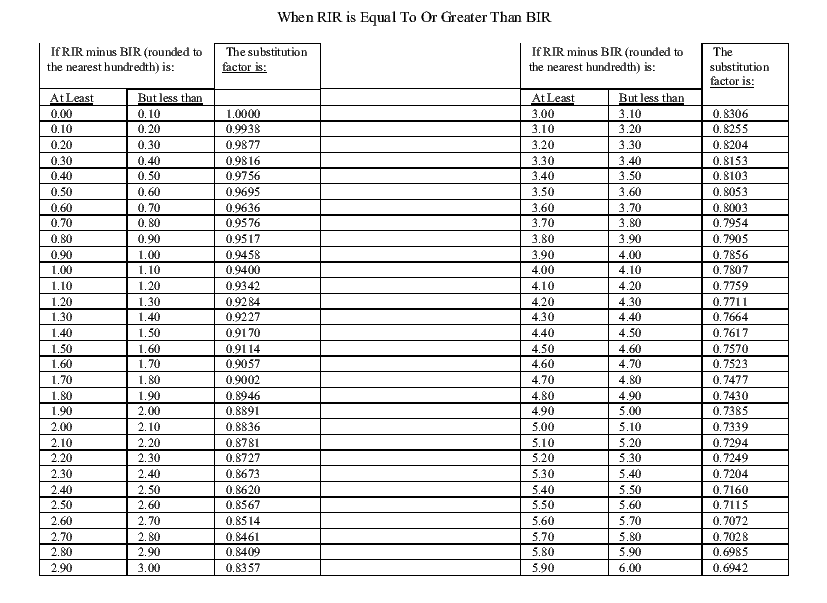

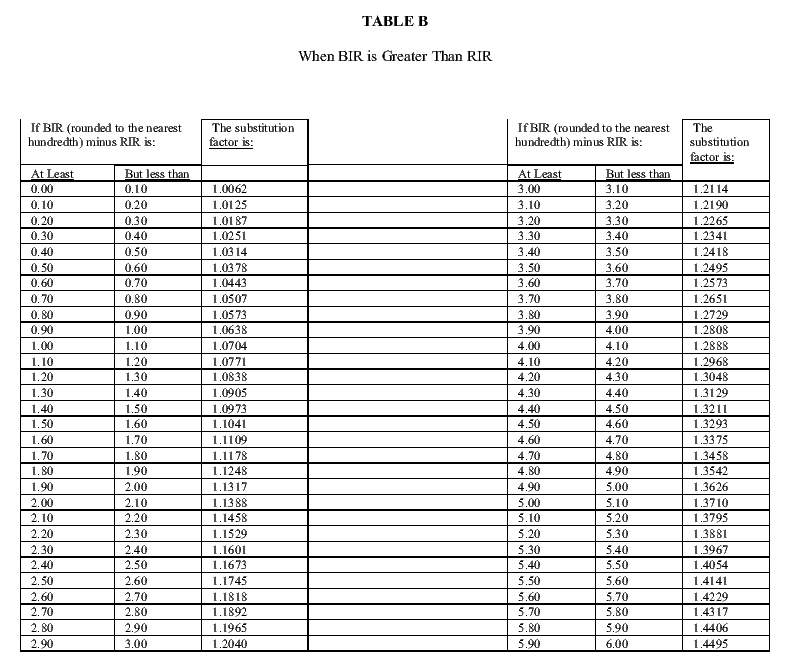

The required interest rate for the variable-rate premium for the 2005 year is again 85 percent of the annual rate of interest determined by the Secretary of the Treasury on amounts invested conservatively in long-term investment grade corporate bonds for the month preceding the beginning of the plan year for which premiums are being paid. The interest rates are on our website at www.pbgc.gov/plan_admin/interest.htm.

We have made a few changes for this year. The enrolled actuary's certification has been shortened and simplified but remains the same in substance. We have added a check box for you to notify us of participation in the PBGC's Participant Notice Voluntary Correction Program (VCP). We have added reporting of the first six digits of the plan sponsor's Committee on Uniform Securities Identification Procedures (CUSIP) number (if any) to help us identify controlled groups related to plan sponsors. See "What's New" on p. 1 of the instructions for more details on changes.

We continue to look for ways to help you, and your suggestions are always welcome. In addition, PBGC's website contains information that you may find useful, including current and prior premium filing booklets, frequently asked questions, interest rates, information on disaster relief, and regulations.

For all premium-related inquiries, please call our toll-free practitioner number, 1-800-736-2444, and select the "premium" option. If you have a complaint about the service you have received or still need assistance after calling our practitioner number, please contact our Problem Resolution Officer at 1-800-736-2444, ext. 4136 (202-326-4136 for local calls) or by e-mail at practitioner.pro@pbgc.gov.

Dept. 77430 P.O. Box 77000 Detroit, MI 48277-0430

Pension Benefit Guaranty Corporation Bank One 9000 Haggerty Road Dept. 77430 Mail Code MI1-8244 Belleville, MI 48111

Bank One, NA Chicago, IL ABA: 071000013 Account: 656510666 Beneficiary: PBGC Reference: (give plan's EIN/PN and the date the premium payment year commenced (PYC) in the format "EIN/PN: XX-XXXXXXX/XXX PYC: MM/DD/YY")

Pension Benefit Guaranty Corporation Dept. 77840 P.O. Box 77000 Detroit, MI 48277-084

Call: (202) 326-4041 Internet: www.pbgc.gov or write to: Pension Benefit Guaranty Corporation CPAD, Suite 240 1200 K Street, NW Washington, DC 20005-4026

Call: 1-800-736-2444 (202) 326-4242 E-mail: standard@pbgc.gov or write to: Pension Benefit Guaranty Corporation IOD/Technical Assistance Branch, Suite 930 1200 K Street, NW Washington, DC 20005-4026

Call: 1-800-736-2444, ext. 4136 (202) 326-4136 E-mail: practitioner.pro@pbgc.gov or write to: Pension Benefit Guaranty Corporation Problem Resolution Officer (Practitioners), Suite 610 1200 K Street, NW Washington, DC 20005-4026

Call: (202) 326-4161 E-Mail: pnotice@pbgc.gov

Call: (202) 326-4161, ext. 6309 E-Mail: pce@pbgc.gov

Pension Benefit Guaranty Corporation Vendor Forms Review Office, FOD/CCD, Suite 670 1200 K Street, NW Washington, DC 20005-4026

The Pension Benefit Guaranty Corporation (PBGC) encourages a stable, adequately funded system of private pension plans and provides responsive, timely, and accurate services to plan sponsors, participants in insured plans, and pension practitioners.

As a plan administrator of a pension plan that pays premiums to PBGC, you are one of PBGC's principal customers. In administering the premium collection program, we:

Of course, our dealings with plan administrators, plan sponsors, and pension practitioners go beyond premium collections. Should a defined benefit pension plan terminate, as either a standard or a distress termination, you have dealings with the PBGC to bring the case to closure

-- what we can do immediately and what will take longer, -- when it will be done, and -- who will handle your request.

The most recent customer satisfaction surveys of pension professionals tell us we've improved our forms and instructions, and filing premium forms is fairly easy to do, but receiving refunds still takes too long. We learned that we can best improve customer satisfaction by focusing on premium statements of account (premium invoices), specifically, getting these to our customers timelier, making the statements themselves clearer, and providing prompter responses to inquiries. We are developing a new premium accounting system that we expect to support these efforts. We have also launched an electronic premium filing system called My Plan Administration Account (My PAA), which is accessible through PBGC's website (www.pbgc.gov). It is our hope that online filing will provide greater convenience to our customers, and we look forward to expanding online services in the future.

Since almost half of all pension plans have an October 15 premium filing deadline, PBGC experiences its peak premium processing season in October through December. Refunds requested during this period will take longer to process due to the increased number of filings received. We continue to seek ways to make our processes more responsive to the needs of the practitioner community.

If you have any questions or complaints, please contact us by telephone, fax, or e-mail at one of the numbers or addresses listed on page ii.

We need this information to determine the amount of premium due to the PBGC under Title IV of ERISA and to monitor single-employer plans' compliance with the Participant Notice requirement in ERISA section 4011 and 29 CFR Part 4011. You are required to give us this information. An agency may not conduct or sponsor, and a person is not required to respond to, a collection of information unless it displays a currently valid OMB control number. OMB has approved this collection of information under control number 1212-0009. Confidentiality is that supplied by the Privacy Act and the Freedom of Information Act.

The estimated burden associated with completing and filing Form 1-EZ or Form 1 (and, for single-employer plans that are not exempt from the variable-rate premium, Schedule A) is shown below. The burden estimates are expressed in hours (for filings done in-house) and in dollar cost (for filings contracted out). (The PBGC assumes that 95% of the burden is contracted out.) The burden estimates are averages for the plans in each of the listed categories. These times will vary depending on the circumstances of a given plan.

| PLAN TYPE | AVERAGE BURDEN | ||

| Single-Employer Plans | |||

| Plans With Under 500 Participants | |||

| Exempt from variable-rate premium | 1.0 hour or $275 | ||

| Not exempt but fully funded | 2.0 hours or $550 | ||

| Underfunded | 4.5 hours or $1,238 | ||

| Plans With 500 or More Participants | |||

| Exempt from variable-rate premium | 1.0 hour or $275 | ||

| Not exempt but fully funded | 2.0 hours or $550 | ||

| Underfunded | 5.5 hours or $1,513 | ||

| Multiemployer Plans | 0.5 hour or $138 | ||

If you have comments concerning the accuracy of these burden estimates or suggestions for making the forms simpler, please send your comments to Pension Benefit Guaranty Corporation, Office of the General Counsel, Suite 340, 1200 K Street, NW, Washington, DC 20005-4026.

In most cases, notice is required within 30 days after the plan administrator or contributing sponsor knows or has reason to know that an event has occurred. In certain cases involving privately-held companies or controlled groups whose pension plans have aggregate unfunded vested benefits of more than $50 million, the contributing sponsor (but not the plan administrator) must notify the PBGC 30 days before the effective date of certain events. See section 4043 of ERISA and PBGC's regulation on Reportable E vents and Certain Other Notification Requirements (29 CFR Part 4043). (From time to time, we also publish technical guidance on our website, www.pbgc.gov (under "Legal Information & FOIA" " "Laws & Regulations" " "Technical Updates") about rep ortable events filing obligations.) Failure to give PBGC timely notice may result in assessment of penalties under section 4071 of ERISA.

The plan administrator of a single-employer plan may be required to issue a Participant Notice for the 2005 plan year " informing participants about the plan's funding status and the limits on the PBGC's guarantee of benefits " if a variable-rate premium (VRP) is payable for the 2005 plan year. The PBGC will issue a Technical Update in mid-2005 describing the requirements for the 2005 Participant Notice and reflecting any legislative changes for 2005.

The premium forms for the 2006 plan year (the next plan year) will include a certification about the Participant Notice for the 2005 plan year (this plan year). (This plan year's premium forms include a certification about the Participant Notice for the 2004 plan year.)

The 2005 Participant Notice is due two months after the due date for the 2004 Form 5500 series, including extensions. Thus, the 2005 Participant Notice is due during the 2005 plan year. For calendar year plans, the 2005 Participant Notice must be given by October 3, 2005, if the 2004 Form 5500 due date is August 1, 2005; by November 15, 2005, if the 2004 Form 5500 due date is September 15, 2005; or by December 19, 2005, if the 2004 Form 5500 due date is October 17, 2005. (Due dates that fall on a weekend or Federal holiday are extended to the next business day.)

EXEMPTIONS: A plan that meets the Deficit Reduction Contribution (DRC) Exception Test for the 2004 plan year or for the 2005 plan year is exempt from having to provide a Participant Notice for the 2005 plan year. Most new and newly-covered plans are also exempt from the Participant Notice requirement.

For more information about the Participant Notice requirement, including information about the DRC Exception Test, see section 4011 of ERISA, the PBGC's regulation on Disclosure to Participants (29 CFR Part 4011), and the PBGC's Technical Update on the 2005 Participant Notice (to be issued in mid-2005). The Technical Update will include a worksheet to help plan administrators determine whether they must issue the 2005 Participant Notice. Further information related to Participant Notice requirements is available on the PBGC's website at www.pbgc.gov/participantnotice.

Although there are special rules regarding Participant Notices for small plans, small plans are not exempt from the Participant Notice requirements.

The best way to ensure accurate and timely filings is to submit your premium filing online using the My Plan Administration Account (My PAA) section of the PBGC's website. The instructions for e-filing your premiums are included in this booklet (see p. 43).

If you are making a paper filing, please:

If you make an amended premium filing that shows an overpayment of more than $500, attach a statement explaining the specific circumstances or events that caused the overpayment and made the amended filing necessary. See B.6.d., p. 15, for more information.

When providing refund payment instructions, please keep in mind that not all banks accept Automated Clearing H ouse (ACH) or electronic funds transfers.

If you are filing for a large plan, remember that an overpayment claimed as a credit on line 7 of Form 1-ES must also be claimed on line 15(b) of your final filing.

Remember that your premium forms must be signed and dated. Failure to sign and date your filing can delay processing of your filing (including any refund that may be due). Processing can also be delayed if you fail to submit a separate payment for each plan. Please do not combine payments for two or more plans in one check or electronic funds transfer.

We also remind you not to place correspondence in the envelope with your premium forms. The forms are processed electronically, and correspondence placed in the same envelope may be significantly delayed in reaching its intended destination. Use the address in item 3. under "CONTACTS," p. ii, to send us correspondence other than your premium filing.

In addition, your filing should be sent without a cover letter. If you need to submit additional information with your filing, it should be in an attachment (and you should check the attachment box in item 19 of Form 1-EZ or item 18 of Form 1).The plan administrator and enrolled actuary certifications have been revised.

For 2005 only, we have added a check box to the Participant Notice information item for you to use to notify the PBGC of the plan's participation in the PBGC's Participant Notice Voluntary Correction Program (VCP) announced in the Federal Register May 7, 2004 (at 69 FR 25792).

If a CUSIP number has been assigned for the plan sponsor, we now require that the first 6 digits of that number be reported. See the instructions for item 8 of Form 1-EZ and Form 1 on pp. 21 and 28.

We will no longer automatically apply an overpayment of a plan's current premium to amounts of premium, interest, and penalty owed for the plan with respect to prior plan years. If you overpay the premium for the current plan year, you will be able to elect either to receive a refund or to have the overpayment applied against the plan's premium for the next plan year. You'll find further details in the instructions (B.7.b., Overpayments, p. 17; also see the instructions for item 17 of the Form 1-EZ and Form 1 on pp. 25 and 30).

We have added instructions to the item on change in plan year starting date for plans filing for the second year that have a different plan year starting date for the second year only because the first year was a short year. See the instructions for item 11(d) on Form 1-EZ (p. 22) and item 12(d) on Form 1 (p. 29).

We have changed the Schedule A instructions that are used by large single-employer plans that calculate the variable-rate premium using the Alternative Calculation Method (ACM) to make clear that significant events adjustments may be offset by "negative" unfunded vested benefits from the Form 5500, Schedule B. See the Item 5 Procedure, p. 39.

We have changed the wording of item 12(d) on Form 1-EZ and item 1(c) on Schedule A to conform with the instructions. Certain filers use these items to report the proposed termination date in a standard termination (on Form 1-EZ) or a distress or involuntary termination (on Schedule A).

This 2005 Premium Payment Package reflects changes brought about by the Pension Funding Equity Act of 2004 (PFEA), which was signed into law by the President on April 10, 2004. (The changes were also reflected in the 2004-R Premium Payment Package, which the PBGC distributed shortly after PFEA was enacted, for 2004 plan year premium filings.) PFEA changes the rules for determining the Required Interest Rate for a premium payment year beginning in 2004 or 2005. Under PFEA, for a premium payment year beginning in 2004 or 2005, the Required Interest Rate is 85 percent of the annual rate of interest determined by the Secretary of the Treasury on amounts invested conservatively in long-term investmentgrade corporate bonds for the month preceding the beginning of the plan year for which premiums are being paid. The definition of "Required Interest Rate" in this 2005 instruction booklet (A.7., p. 5) reflects this provision.

In 2004, we launched an electronic premium filing system called My Plan Administration Account (My PAA). My PAA enables practitioners to electronically create, sign, and submit premium filings and payments to PBGC for plan years beginning in 2004 or later years. E-filing has many advantages over paper submissions, including improved data accuracy, easier filing preparation, shared electronic access to filings (which eliminates manual routing and mailing), e-mail notification of required actions, and confirmation that the filing and payment were received by PBGC. Please see Part G, p. 43, for more information about how to e-file premiums for 2005. For additional details or to set up an account within My PAA, please access PBGC's website (www.pbgc.gov/mypaa) and click on the link labeled "New Users Click Here for More Information and Sign Up."

In October 2003, we changed the rules for filing with us. See "When to File" (B.2.e., p. 10) for more information. Under the new rules, your filing date will generally be the date you send your filing.

PBGC premium forms (both paper and on-line forms) are used to pay premiums to the Pension Benefit Guaranty Corporation (PBGC) as required by sections 4006 and 4007 of the Employee Retirement Income Security Act, as amended (ERISA), and the PBGC's premium regulations (29 CFR Parts 4006 and 4007). There are two kinds of premiums: the flat-rate premium, which applies to all plans, and the variable-rate premium, which applies only to single-employer plans.

Every plan covered under section 4021 of ERISA must make a premium filing each year, either by filing Form 1 or Form 1-EZ (whichever applies to the plan) or by filing electronically (as described in Part G of this booklet). Single-employer plans that file Form 1 must also file Schedule A. These three forms are included in this booklet. The table on page 11 shows which form(s) to file, and the instructions in this booklet tell how to complete Form 1, Form 1-EZ, and Schedule A and how to pay the premium due. In addition, most large plans must also file Form 1-ES (which is issued in a separate booklet) or make an equivalent electronic filing (as described in that booklet).

Your premium filing will be considered improper if it is not made in accordance with the premium regulations and instructions, if it is not accompanied by the required premium payment, or if it is otherwise incomplete. Subparts 3 through 9 of this Part A tell you the definitions of special terms that are used in these instructions.

"ERISA" means the Employee Retirement Income Security Act of 1974, as amended (29 U.S.C. 1001 et seq.).

"Code" means the Internal Revenue Code of 1986, as amended.

"Premium regulations" means the PBGC's regulations on Premium Rates and Payment of Premiums (29 CFR Parts 4006 and 4007). The premium forms and instructions are issued under and implement the premium regulations.

"We" or "us" refers to the Pension Benefit Guaranty Corporation.

"You" or "your" refers to the administrator of a pension plan.

"Plan sponsor" means the employer(s), employee organization, association, committee, joint board of trustees, or other entity that maintains a plan.

"Plan administrator" means

a. the person specifically so designated by the terms of the instrument under which the plan is operated; or

b. if an administrator is not so designated, the plan sponsor.

"Form 1" means the Annual Premium Payment Form 1 issued by the PBGC and includes, for single-employer plans, the Schedule A.

"Form 1-EZ" means the Annual Premium Payment Form 1-EZ for Single-Employer Plans Exempt from the Variable-Rate Premium, issued by the PBGC.

"Form 1-ES" means the Estimated Premium Payment Form 1-ES issued by the PBGC (in a separate booklet) for estimating the flat-rate premium for certain large single-employer plans and the total premium for certain large multiemployer plans.

"Schedule A" means the schedule to the Form 1 that is used by single-employer plans that are not exempt from the variable-rate premium to report unfunded vested benefits and compute the variable-rate premium.

"Form 5500 series" means Form 5500, Annual Return/Report of Employee Benefit Plan, jointly developed by the Internal Revenue Service, the Department of Labor, and the PBGC. (Copies of this form may be obtained from the Internal Revenue Service or the Department of Labor.)

"Schedule B" means Schedule B to the Form 5500 series.

"EIN" means Employer Identification Number. It is always a 9-digit number assigned by the Internal Revenue Service for tax purposes.

"PN" means Plan Number. This is always a 3-digit number. The plan sponsor assigns this number to distinguish among employee benefit plans established or maintained by the same plan sponsor. A plan sponsor usually starts numbering pension plans at "001" and uses consecutive Plan Numbers for each additional plan. Once a PN is assigned, always use it to identify the same plan. If a plan is terminated, retire the PN " do not use it for another plan.

"CUSIP number" means a nine-digit number assigned to the publicly traded securities of a plan sponsor (or member of the sponsor's controlled group) under the securities numbering system of the Committee on Uniform Securities Identification Procedures. The first six digits of the CUSIP number identify the securities issuer, the next two digits identify the specific securities issue, and the last digit is a check digit.

"Premium payment year" means the plan year for which the premium is being paid.

"Premium Snapshot Date" means the last day of the plan year preceding the premium payment year (e.g., 12/31/2004 for a calendar year plan's 2005 premium payment year) except as follows:

a. For a new plan or newly covered plan, the premium snapshot date is the first day of the premium payment year, or the first day the plan became effective for benefit accruals for future service, if that is later. (If a newly created plan covered under section 4021 of ERISA is adopted retroactively (i.e., the adoption date of the plan is after its effective date), either the adoption date or the effective date may be used as the premium snapshot date. However, whatever date is used as the premium snapshot date must also be considered the first day of the plan year for purposes of prorating the premium (if you prorate) and for purposes of determining the premium due date. Thus, if you determine the plan's Final Filing Due Date as the 15th day of the 10th full calendar month that begins on or after the first day of the premium payment year (i.e., under B.2.b.(i), p. 8), you must use the first day of the premium payment year as the premium snapshot date. Similarly, if you prorate the plan's firstyear premium, you must use the premium snapshot date as the first day of the plan year (see B.5., p. 13).)

b. If the plan is the transferee plan in a merger or the transferor plan in a spinoff to a new plan and the transaction meets the conditions described in (i) and (ii) below, the premium snapshot date is the first day of the premium payment year. A plan merger or spinoff (as defined in the regulations under section 414(l) of the Code) is covered by this rule if

(i) a merger is effective on the first day of the transferee (the continuing) plan's plan year, or a spinoff is effective on the first day of the transferor plan's plan year, and

(ii) the merger or spinoff is not de minimis, as defined in the regulations under section 414(l) of the Code with respect to single-employer plans, or in the PBGC's regulation under ERISA section 4231 (29 CFR Part 4231) with respect to multiemployer plans.

The following examples illustrate the determination of the premium snapshot date. Examples 1 and 2 illustrate the usual rule (where the premium snapshot date is the last day of the plan year preceding the premium payment year). Examples 3 and 4 illustrate the situation for a new plan (where the premium snapshot date is the first day of the premium payment year, or the first day the plan became effective for benefit accruals for future service, if that is later). Examples 5 and 6 illustrate the situation for plans involved in certain mergers and spinoffs (where the premium snapshot date is the first day of the premium payment year).

Example 1 An ongoing plan has a plan year beginning September 1, 2005, and ending August 31, 2006. The premium snapshot date is August 31, 2005.

Example 2 An ongoing plan changes its plan year from a calendar year to a plan year that begins June 1, effective June 1, 2005. For the plan year beginning January 1, 2005, the premium snapshot date is December 31, 2004. For the plan year beginning June 1, 2005, the premium snapshot date is May 31, 2005.

Example 3 A new calendar-year plan is adopted December 10, 2004, effective January 1, 2005. The premium snapshot date is January 1, 2005.

Example 4 A new calendar-year plan is adopted February 18, 2005, retroactively effective as of January 1, 2005. The plan administrator may select either January 1 or February 18, 2005, as the premium snapshot date; the date selected must also be used for purposes of prorating the premium for the plan's first year.

Example 5 Plan A has a calendar plan year and Plan B has a July 1 - June 30 plan year. Effective January 1, 2005, Plan B merges into Plan A (and the merger is not de minimis). Plan A's premium snapshot date is January 1, 2005. (Since Plan B did not exist at any time during 2005, it does not owe a premium for the 2005 plan year.)

Example 6 Plan A has a calendar plan year. Effective January 1, 2005, Plan A spins off assets and liabilities to form a new plan, Plan B (and the spinoff is not de minimis). Plan A's premium snapshot date is January 1, 2005. (Plan B's premium snapshot date also is January 1, 2005, since it is a new plan that became effective on that date.)

"First Filing Due Date" means the date by which the flat-rate premium must be paid by a plan whose participant count for the prior year was 500 or more. For most plans, it is the last day of the 2nd full calendar month following the close of the preceding plan year (the last day of February for calendar-year plans). A different rule applies for plans changing plan years. For more details, see B.2.a. (p. 8) and B.2.c. (p. 9).

"Final Filing Due Date" means the date by which

a. Flat-rate premiums must be paid by plans to which the First Filing Due Date doesn't apply,

b. Variable-rate premiums must be paid by all singleemployer plans, and

c. Flat-rate reconciliation filings (if necessary) must be made by plans to which the First Filing Due Date applies.

For most plans, the Final Filing Due Date is the 15th day of the 10th full calendar month following the end of the plan year preceding the premium payment year (October 15 for calendar-year plans). Different rules apply for plans filing for the first time or changing plan years. For more details, see B.2.a. (p. 8), B.2.b. (p .8), and B.2.c. (p. 9).

"Filing Due Date" means either the First Filing Due Date or the Final Filing Due Date.

"Flat-rate premium" means the portion of the premium determined by multiplying the flat-rate premium charge by the number of participants in the plan on the premium snapshot date. The per-participant flat-rate charge for plan years beginning in 2005 is $19 for singleemployer plans and $2.60 for multiemployer plans.

"Variable-rate premium" means the portion of the single-employer premium based on a plan's unfunded vested benefits. The variable-rate premium for plan years beginning in 2005 is $9 for every $1,000 (or fraction thereof) of unfunded vested benefits.

"Participant" in a plan means an individual (whether active, inactive, retired, or deceased) with respect to whom the plan has benefit liabilities.

a. Benefit liabilities are all liabilities with respect to employees and their beneficiaries under the plan (within the meaning of Code section 401(a)(2)). Thus, benefit liabilities include liabilities for all accrued benefits, whether or not vested. In addition, a plan's benefit liabilities include liabilities for ancillary benefits not directly related to retirement benefits, such as disability benefits not in excess of the qualified disability benefit, life insurance benefits payable as a lump sum, incidental death benefits, or current life insurance protection. (See Treasury Regulation § 1.411(a)-7(a)(1).)

b. An individual is not counted as a participant after all benefit liabilities with respect to the individual are distributed through the purchase of irrevocable commitments from an insurer or otherwise. In addition, a non-vested individual is not counted as a participant after (1) a deemed "zero-dollar cashout," (2) a one-year break in service under plan rules, or (3) death.

i. Cashouts. If the plan has a separate cashout provision for zero benefits, terminated non-vested participants are deemed to be cashed out as of the date specified in the deemed cashout provision or, if no date is specified, as of the employment termination date. If the plan provides that zero benefit amounts will be deemed to be paid as soon as possible, terminated non-vested participants also will be deemed to be cashed out as of the employment termination date.

If the plan does not have a separate cashout provision for zero benefits but does have a mandatory cashout of small benefit amounts (e.g., benefits less than $5,000), terminated non-vested participants are deemed to be cashed out in the same manner as terminated vested participants. If the plan is silent as to the timing of actual cashouts of terminated vested participants, the plan is deemed to read "as soon as practicable" and the terminated non-vested participants are deemed to be cashed out immediately upon termination of employment. If the plan specifies a date as of which actual cashouts of terminated vested participants take place (e.g., on the first day of the next month), that rule also would apply to deemed cashouts of terminated non-vested participants. These rules do not apply if, despite plan language, the plan has an obvious pattern or practice of delaying distributions for long periods of time.

For example, suppose a calendar-year plan provides that if a participant terminates employment and the participant's vested benefit has a value of less than $5,000, the plan will pay the vested benefit to the participant in a lump sum as of the first of the month following termination of employment. Suppose further that no plan provisions specifically address payment of benefits upon termination of employment by non-vested participants. If a participant with a non-vested accrued benefit terminates employment on December 15, 2004, the participant will be included in the participant count as of December 31, 2004 (because the cashout is deemed to occur on January 1, 2005, the first of the month following termination of employment). If, as is typically the case for a calendar year plan, the plan's premium snapshot date for 2005 is December 31, 2004, a flat-rate premium must be paid for this participant for 2005.

ii. Breaks in service. A terminated non-vested individual ceases to be a participant for premium purposes when the individual incurs a one-year break in service under the plan, regardless of the length of the individual's absence from employment. For example, suppose that a calendar-year plan provides that a participant who performs 500 or fewer hours of service in a service computation period incurs a one-year break in service for that computation period. An individual might incur a oneyear break in service under the plan before December 31, 2004 (the premium snapshot date for the 2005 premium) if the individual left employment on February 1, 2004, and did not perform more than 500 hours of service during a computation period ending on November 30, 2004, even though December 31, 2004, comes before the first anniversary of the individual's separation from employment. This individual would not be included in the participant count for 2005.

If a non-vested individual incurs a break in service in a service computation period that coincides with the plan year preceding the premium payment year, we treat the individual as not being a participant for purposes of determining the premium for the premium payment year. For example, suppose a calendar-year hours-of-service plan requires more than 500 hours of service in a service computation period to avoid a break in service, and a nonvested participant in the plan earns 440 hours of service in the service computation period ending December 31, 2004. The PBGC would treat the individual as not being a participant for purposes of the plan's 2005 premium. (For more detail, see the amendment to the premium regulations' definition of "participant," published in the Federal Register on December 1, 2000, at 65 FR 75160.)

c. Beneficiaries and alternate payees. Benficiaries and alternate payees are not counted as participants. However, a deceased participant will continue to be counted as a participant if there are one or more beneficiaries or alternate payees who are receiving or have a right to receive benefits earned by the participant.

"Significant Event" means any of the following events:

(1) an increase in the plan's actuarial costs (consisting of the plan's normal cost under section 412(b)(2)(A) of the Code, amortization charges under section 412(b)(2)(B) of the Code, and amortization credits under section 412(b)(3)(B) of the Code) attributable to a plan amendment, unless the cost increase attributable to the amendment is less than 5% of the actuarial costs determined without regard to the amendment;

(2) the extension of coverage under the plan to a new group of employees resulting in an increase of 5% or more in the plan's liability for accrued benefits;

(3) a plan merger, consolidation, or spinoff that is not de minimis pursuant to the regulations under section 414(l) of the Code;

(4) the shutdown of any facility, plant, store, etc., that creates immediate eligibility for benefits that would not otherwise be immediately payable for participants separating from service;

(5) the offer by the plan for a temporary period to permit participants to retire at benefit levels greater than that to which they would otherwise be entitled;

(6) a cost-of-living increase for retirees resulting in an increase of 5% or more in the plan's liability for accrued benefits; and

(7) any other event or trend that results in a material increase in the value of unfunded vested benefits.

"Required Interest Rate" for a premium payment year beginning in 2004 or 2005 is the "applicable percentage" (currently 85 percent) of the annual rate of interest determined by the Secretary of the Treasury on amounts invested conservatively in long-term investmentgrade corporate bonds for the calendar month preceding the calendar month in which the premium payment year begins.

Note: Section 4006(a)(3)(E)(iii) of ERISA states that the Required Interest Rate is the "applicable percentage" of the annual yield on 30-year Treasury securities for the calendar month preceding the calendar month in which the premium payment year begins. However, the Pension Funding Equity Act of 2004 temporarily changes the Required Interest Rate for a premium payment year beginning in 2004 or 2005 by substituting, for the annual yield on 30-year Treasury securities, the annual rate of interest determined by the Secretary of the Treasury on amounts invested conservatively in long-term investmentgrade corporate bonds. (The provisions of the Job Creation and Worker Assistance Act of 2002 that had temporarily increased the Required Interest Rate to be used to determine the PBGC's variable-rate premium from 85 percent of the annual yield on 30-year Treasury securities to 100 percent of that yield figure expired at the end of 2003.)

On or about the 15th of each month, the PBGC publishes in the Federal Register a list of the Required Interest Rates for the preceding 12 months. In addition, for your convenience, the Required Interest Rate is posted on the PBGC's website. The Required Interest Rate also can be obtained by calling (202) 326-4041.

For purposes of determining whether a plan is a multiemployer plan or a single-employer plan, all trades or businesses (whether or not incorporated) that are under common control are considered to be one employer.

"Multiemployer plan" means a plan -

a. to which more than one employer is required to contribute,

b. which is maintained pursuant to one or more collective bargaining agreements between one or more employee organizations and more than one employer, and

c. which satisfies such other requirements as the Secretary of Labor may prescribe by regulation. (The above definition does not apply to a plan that elected on or before September 26, 1981, with PBGC's approval, not to be treated as a multiemployer plan (see ERISA section 4303). Such a plan is treated as a singleemployer plan.)

Single-employer plan" means any plan that does not meet the above definition of multiemployer plan. A single-employer plan includes a "multiple employer" plan.

"Multiple employer plan" means a plan -

a. to which more than one employer contributes, and

b. that does not satisfy the definition of multiemployer plan, or that elected on or before September 26, 1981, with PBGC's approval, not to be treated as a multiemployer plan (see ERISA section 4303).

Plan "mergers" and plan "consolidations" are transactions in which one or more transferor plans transfer all of their assets and liabilities to a transferee plan and disappear (because they become part of the transferee plan). However, there are important differences between the two kinds of transactions. In a merger, the transferee plan is one that existed before the transaction. In a consolidation, the transferee plan is a new plan that is created in the consolidation. Thus, the plan that exists after a consolidation follows the premium filing rules for new plans. In particular, it need not make an early premium payment with Form 1-ES (no matter how many participants any of the transferor plans had for the prior year(s)) and its filing due date is subject to the special rules for new plans. On the other hand, the transferee plan in a merger follows the normal rules for preexisting, ongoing plans.

In a "spinoff," the transferor plan transfers only part of its assets and/or liabilities to the transferee plan. The transferee plan may be a new plan that is created in the spinoff, or it may be a preexisting plan that simply receives part of the assets and/or liabilities of the transferor plan.

The plan administrator of each single-employer plan and multiemployer plan covered under section 4021 of ERISA is required annually to file the prescribed premium information (either on the paper premium form(s) or electronically) and pay the premium due. Most privatesector defined benefit plans that meet tax qualification requirements are covered. If you are uncertain whether your plan is covered under section 4021, you should promptly request a coverage determination. Contact us as described in item 5. under "CONTACTS" on p. ii.

A request for a coverage determination does not extend the due date for any premium that is finally determined to be due.

It is the responsibility of the plan administrator to obtain and complete the applicable premium forms (or file electronically) and make the premium payment each year.

If your plan is covered under section 4021 of ERISA, you must make a premium filing even if no premium is owed. This may happen if your plan is a new plan that grants no past service credits, so that there are no benefit liabilities on the premium snapshot date. (A plan with no benefit liabilities has no participants for premium purposes (see the instructions for item 13 of Form 1-EZ (p. 24) or Form 1 (p. 29)) and no unfunded vested benefits.) The premium filing certifies that there are no participants and that no premium is owed.

If several unrelated employers participate in a program of benefits wherein the funds attributable to each employer are available to pay benefits to all participants, then there is a single multiple-employer plan and the plan administrator must file and pay premiums for the plan as a whole. Separate filings and premiums cannot be submitted for each individual employer.

If several employers participate in a program of benefits wherein the funds attributable to each employer are available only to pay benefits to that employer's employees, then there are several plans (one for each employer) and the plan administrator must file and pay premiums separately for the plan of each individual employer.

If separate plans are maintained for different groups of employees, regardless of whether each has the same sponsor or the sponsors are part of the same controlled group, then the plan administrator(s) must file and pay premiums separately for each plan.

You must continue to make premium filings and pay premiums through and including the plan year in which any of the following occurs:

If a plan terminates and a new plan is established, premiums are due for the terminated plan as described above, and premiums are also due for the new plan from the first day of its first plan year (see B.2.b., p. 8).

Example 1 A calendar year plan terminates in a standard termination with a termination date of September 30, 2004. On April 7, 2005, assets are distributed in satisfaction of all benefit liabilities. Since the terminating plan is undergoing a standard termination, no trusteeship is involved. The plan administrator must file and make the premium payments due for the 2004 and 2005 plan years. (The 2005 premium may be prorated. See B.5., p. 13.)

Example 2 A plan with a plan year beginning July 1 and ending June 30 terminates in a distress termination with a termination date of April 28, 2005. On July 7, 2005, a trustee is appointed to administer the plan under ERISA section 4042. Premium forms and payments must be filed for this plan for both the 2004 and 2005 plan years, because a trustee was not appointed until after the beginning of the 2005 plan year. (The 2005 premium may be prorated. See B.5., p. 13.)

There are two Filing Due Dates " the First Filing Due Date and the Final Filing Due Date. For most plans:

There are special due date rules for plans filing for the first time (see B.2.b., p. 8) and plans changing plan years (see B.2.c., p. 9).

The First Filing Due Date applies only to the flat-rate premium filings for certain large plans. Whether you need to make a flat-rate premium filing and payment by the First Filing Due Date depends on the number of plan participants for whom you were required to pay premiums for the plan year preceding the premium payment year (i.e., for 2005 premiums, the 2004 participant count).

Plans that were required to pay premiums for 500 or more participants for the preceding plan year must pay the flat-rate premium (or an estimate) with an appropriate form (e.g., Form 1-ES or electronic equivalent) by the First Filing Due Date. If an estimated filing is made, or if the plan"s total premium is not paid in full, the plan must make a final (reconciliation) filing with any required payment by the Final Filing Due Date. Only the flat-rate premium is due by the First Filing Due Date; the variablerate premium for single-employer plans is due by the Final Filing Due Date. For multiemployer plans (which pay only the flat-rate premium), the entire premium is due by the First Filing Due Date.

Example A new calendar-year plan was adopted and effective on January 1, 2004, and had 650 participants on that date. Since the plan was not required to pay premiums for 2003 (because it was not in existence then), it was not required to pay its 2004 flat-rate premium by the First Filing Due Date in 2004 (March 1, 2004). It was required to pay its 2004 flat-rate and variable-rate premiums by the 2004 Final Filing Due Date (October 15, 2004). As a new plan, its 2004 premium snapshot date was January 1, 2004 (the first day of the plan year). The 2004 flat-rate premium was based on a participant count of 650 as of January 1, 2004.

The number of participants decreases during 2004, and the participant count on December 31, 2004, is 450. For 2005, the participant count (450) is determined as of December 31, 2004, the plan"s 2005 premium snapshot date. The plan must pay a flat-rate premium for 450 participants by the First Filing Due Date (February 28, 2005) because it was required to pay premiums for 650 participants for the preceding year (2004), determined as of January 1, 2004, its 2004 premium snapshot date.

A plan required to pay premiums for fewer than 500 participants for the preceding year is required to make its premium filing and pay the entire premium due by the Final Filing Due Date.

The following table shows the Filing Due Dates for most plans for the 2005 premium payment year.

| 2005 | ||

| Filing Due Dates | ||

| Premium Payment Year Begins | First Filing Due Date | Final FIling Due Date |

| 01/01/2005 | 02/28/2005 | 10/17/2005* |

| 01/02 - 02/01/2005 | 03/31/2005 | 11/15/2005 |

| 02/02 - 03/01/2005 | 05/02/2005* | 12/15/2005 |

| 03/02 - 04/01/2005 | 05/31/2005 | 01/17/2006* |

| 04/02 - 05/01/2005 | 06/30/2005 | 02/15/2006 |

| 05/02 - 06/01/2005 | 08/01/2005* | 03/15/2006 |

| 06/02 - 07/01/2005 | 08/31/2005 | 04/17/2006* |

| 07/02 - 08/01/2005 | 09/30/2005 | 05/15/2006 |

| 08/02 - 09/01/2005 | 10/31/2005 | 06/15/2006 |

| 09/02 - 10/01/2005 | 11/30/2005 | 07/17/2006* |

| 10/02 - 11/01/2005 | 01/03/2006* | 08/15/2006 |

| 11/02 - 12/01/2005 | 01/31/2006 | 09/15/2006 |

| 12/02 - 12/31/2005 | 02/28/2006 | 10/16/2006* |

*NOTE: If your filing is not made by this date, penalty and interest will be calculated from the last day of the month (for Form 1-ES) or the 15th of the month (for Form 1-EZ or Form 1) rather than the following business day " e.g., from Saturday 10/15/2005 rather than Monday 10/17/2005, or from Saturday 4/30/2005 rather than Monday 5/2/2005.

New and newly covered plans do not pay an estimated premium by a First Filing Due Date. For a plan filing for the first time, the "Final Filing Due Date" is the latest of the following dates:

If the adoption date of a newly created plan covered under section 4021 of ERISA is after its effective date (i.e., the plan is adopted retroactively), the first day of the premium payment year that you use for purposes of paragraph (i) above must also be used as the premium snapshot date.

The following examples show how the definition of the Final Filing Due Date works for plans filing for the first time.

Example 1 A new plan has a calendar plan year. The plan was adopted October 1, 2004, and became effective for benefit accruals January 1, 2005. The Final Filing Due Date for the 2005 plan year is October 17, 2005.

Example 2 A new plan is adopted on December 1, 2005, and has a July 1 - June 30 plan year. The plan became effective for benefit accruals for future service on December 1, 2005. The Final Filing Due Date for the plan's first year, December 1, 2005, through June 30, 2006, is September 15, 2006. (The 2005 premium may be prorated. See B.5., p. 13.)

Example 3 A newly created plan covered under section 4021 of ERISA has a calendar plan year. The plan was adopted on August 16, 2005, with a retroactive effective date of January 1, 2005. If the plan administrator elects to use January 1, 2005, as the premium snapshot date, the Final Filing Due Date for the 2005 plan year is November 14, 2005 (90 days after the date of the plan's adoption). If the plan administrator elects to use August 16, 2005, as the premium snapshot date, the Final Filing Due Date for the 2005 plan year is June 15, 2006 (the 15th day of the tenth full calendar month that begins on or after August 16, 2005, the first day of the premium payment year). (If August 16, 2005, is used as the first day of the premium payment year, the premium for the short plan year may be prorated. See B.5., p. 13.)

Example 4 A professional service employer maintains a plan with a calendar plan year. If this type of plan has never had more than 25 active participants since September 2, 1974, it is not a covered plan under ERISA section 4021. On October 15, 2005, the plan, which always had 25 or fewer active participants, has 26 active participants. It is now a covered plan and will continue to be a covered plan regardless of how many active participants the plan has in the future. The Final Filing Due Date for the 2005 plan year is January 13, 2006, 90 days after the date on which the plan became covered. (The premium for the short plan year may be prorated. See B.5., p. 13.)

For a plan that changes its plan year, the Filing Due Dates for the short year are unaffected by the change in plan year. For the first plan year under the new plan year cycle:

The following examples show how the definition of the Final Filing Due Date works for plans changing plan years.

Example 1 By plan amendment adopted on December 1, 2004, a plan changes from a plan year beginning January 1 to a plan year beginning June 1. This results in a short plan year beginning January 1, 2005, and ending May 31, 2005. The plan always has fewer than 500 participants. The Final Filing Due Date for the short plan year is October 17, 2005. The Final Filing Due Date for the new plan year beginning on June 1, 2005, is March 15, 2006. (The premium for the short plan year may be prorated. See B.5, p. 13.)

Example 2 By plan amendment adopted on January 3, 2006, and made retroactively effective to April 1, 2005, a plan changes from a plan year beginning on March 1 to a plan year beginning on April 1. The plan always has fewer than 500 participants. The Final Filing Due Date for the short plan year that began on March 1, 2005, is December 15, 2005. The Final Filing Due Date for the new plan year, which began April 1, 2005, is February 2, 2006, 30 days after the adoption of the plan amendment changing the plan year. (The premium for the short plan year may be prorated. See B.5, p. 13.)

Example 3 By plan amendment adopted on July 5, 2005, and made retroactively effective to May 1, 2005, a plan changes from a plan year beginning February 1 to a plan year beginning May 1. The plan always has 500 or more participants. The First Filing Due Date for the short plan year is March 31, 2005, and the Final Filing Due Date is November 15, 2005. The First Filing Due Date for the new plan year, which began May 1, 2005, is August 4, 2005, which is the later of the end of the second full calendar month after the close of the short plan year or 30 days after adoption of the plan amendment. The Final Filing Due Date is February 15, 2006. (The premium for the short plan year may be prorated. See B.5, p. 13.)

Example Plans with plan years beginning on July 1, 2005, normally would have a Final Filing Due Date of April 15, 2006. Because that day is a Saturday, the due date is Monday, April 17, 2006.

You may make your premium filing and payment (if by check, with your premium form) by hand, mail, commercial delivery service, or electronically. You can find detailed rules on filing methods and on how we determine your filing date (for electronic filings as well as for other filings) in Part 4000 of our regulations (available on the PBGC's website, www.pbgc.gov).

The discussion below describes the rules for filings other than electronic filings. See Part B.4.b.ii., p. 13 of these instructions for information on electronic funds transfers. See p. 43 for information about how to file electronically using My PAA, our new electronic premium filing method.

Under our filing rules, your filing date is the date you send your filing, provided you meet certain requirements that are summarized below. If you do not meet these requirements, your filing date is the date we receive your submission. However, if we receive your submission after 5:00 p.m. (our time) on a business day, or anytime on a weekend or Federal holiday, we treat it as received on the next business day. (If you file your submission by hand, your filing date is the date of receipt of your handdelivered submission at the proper address.)

Filings by mail. If you file your submission using the U.S. Postal Service, your filing date is the date you mail your submission by the last collection of the day, provided the submission: (1) meets the applicable postal requirements; (2) is properly addressed; and (3) is sent by First-Class Mail (or another class that is at least equivalent). (If you mail the submission after the last collection of the day, or if there is no scheduled collection that day, your filing date is the date of the next scheduled collection.) If you meet these requirements, we make the following presumptions:

Legible postmark date. If your submission has a legible U.S. Postal Service postmark, we presume that the postmark date is the filing date.

Legible private meter date. If your submission has a legible postmark made by a private postage meter (but no legible U.S. Postal Service postmark) and arrives at the proper address by the time reasonably expected, we presume that the metered postmark date is your filing date.

Filings using a commercial delivery service. If you file your submission using a commercial delivery service, your filing date is the date you deposit your submission by the last scheduled collection of the day for the type of delivery you use (such as two-day delivery or overnight delivery) with the commercial delivery service, provided that the submission meets the applicable requirements of the commercial delivery service and is properly addressed, and the delivery service meets one of the requirements listed below. If you deposit it later than that last scheduled collection of the day, or if there is no scheduled collection that day, your filing date is the date of the next scheduled collection. The delivery service must meet one of the following requirements:

Delivery within two days. It must be reasonable to expect your submission will arrive at the proper address by 5:00 p.m. on the second business day after the next scheduled collection; or

Designated delivery service. You must use a "designated delivery service" under section 7502(f) of the Internal Revenue Code (Title 26, USC). Our website, www.pbgc.gov, lists those designated delivery services. You should make sure that both the provider and the particular type of delivery (such as two-day delivery) are designated.

Example A calendar year plan has a Final Filing Due Date for the Form 1 of October 15. The corporate plan sponsor applies for the 2½-month Form 5500 extension. This would make the due date for the Form 5500 series (which is normally July 31 for a calendar year plan) also October 15.

You must make your final premium filing by the Final Filing Due Date using the following form(s):

| Type of plan | Form(s) to use |

| Multiemployer plan | Form 1 alone |

| Single-employer plan that claims an exemption from the variable rate premium | Form 1-EZ alone |

| Single-employer plan that does not claim an exemption from the variable-rate premium (even if the variable-rate premium is zero) | Form 1 with Schedule A |

In addition, the flat-rate premium for a plan in any of these three categories must be paid by the First Filing Due Date if the plan had 500 or more participants for the plan year preceding the premium payment year. These filings may be made on an estimated basis either electronically or using Form 1-ES (issued in a separate booklet). If you know all the information needed to make a final filing (electronically or using Form 1-EZ or Form 1) before the First Filing Due Date, you may make a final filing instead of an estimated filing. If you make an estimated filing, you will still be required to make a final filing by the Final Filing Due Date.

Plans that were required to report 500 or more participants on their final premium filing for 2004 use the 2005 Form 1-ES, which is issued in a separate booklet, to make initial 2005 payments of the flat-rate premium based on an estimated participant count. These plans use Form 1-EZ or Form 1 to make a subsequent reconciliation filing based on an actual participant count.

Your filing should be sent without a cover letter. If you need to submit additional information with your filing, it should be in an attachment (and you should check the attachment box in item 19 of Form 1-EZ or item 18 of Form 1)

A single-employer plan may claim an exemption from the variable-rate premium only if it meets the requirements for one of the exemptions described in the instructions for item 12 of Form 1-EZ in Part C. Having a variable-rate premium of zero is not the same as being exempt from the variable-rate premium. To be exempt, the plan must meet the requirements for one of the exemptions. Briefly, the exemptions in item 12 of Form 1-EZ are for:

For a more complete description, see the instructions for item 12 of Form 1-EZ in Part C, p. 22.

If your plan has a variable-rate premium of zero and also qualifies for an exemption from the variable-rate premium, you may either file Form 1-EZ (claiming the exemption) or file Form 1 and Schedule A (reporting a variable-rate premium of zero). In general, it will be easier to file Form 1-EZ.

(For example, a new plan that has no benefit liabilities on the premium snapshot date will have no unfunded vested benefits and thus will also qualify for the exemption for plans with no vested participants and, if it is a small plan, for the exemption for fully funded small plans.)

Forms are included in the Premium Payment Package. You may also use forms downloaded from the PBGC website (www.pbgc.gov) or computer-generated forms provided by a vendor that has received PBGC approval for automated (computer-generated) versions of the forms. In addition, for premium payment years beginning after 2001, we will accept photocopies of the forms. The forms you file must have original signatures. It is your responsibility as plan administrator to obtain the necessary forms and submit filings on time. (You should ensure that you maintain an updated address with the PBGC so that we can mail your next Premium Payment Package to you. See Part C, item 2, p. 19, or Part D, item 2, p. 26, and B.6.e., p. 16.)

We will mail a 2005 Premium Payment Package containing Form 1-EZ, Form 1, and Schedule A, and, as appropriate, a 2005 Estimated Premium Payment Package containing Form 1-ES, to the plan administrator of each ongoing plan for which a 2004 Form 1-EZ or Form 1 was filed, unless you have indicated that you do not want paper forms and instructions sent to you. We mail these packages to the address shown in item 2 of the 2004 Form 1-EZ or Form 1. We mail the Premium Payment Package seven months before the expected Final Filing Due Date, and the Estimated Premium Payment Package two months before the expected First Filing Due Date.

If you are a plan administrator and you do not receive a Premium Payment Package and/or Estimated Premium Payment Package, or if you need extra copies, contact us as described in item 3. under "CONTACTS" on p. ii.

You may also obtain extra copies of the Premium Payment Package and/or Estimated Premium Payment Package and forms from the Employee Benefits Security Administration of the U.S. Department of Labor (see addresses at the end of this Premium Payment Package).

If you are a pension practitioner serving many covered plans, you may wish to receive a bulk shipment of the Premium Payment Package and/or Estimated Premium Payment Package and forms. If so, complete the order blank at the end of this Premium Payment Package. Check the applicable box on the order blank

There are some companies that will provide software that generates PBGC-approved forms. These forms have been given a 6- digit approval number that appears on each form. These forms are acceptable for submission. In addition, you may download premium forms from the PBGC website (www.pbgc.gov).

To achieve the best results when printing computergenerated or downloaded forms, use a laser or inkjet printer with resolution of 300 DPI (dots per inch) or higher. Please make sure that you have adequate toner in your printer cartridge. Thermal or dot matrix (9 or 24 pin) printers are not recommended for printing the premium forms. Do not use any printing options, such as "Fit to Page," that may tend to enlarge or reduce the size of the image. Please make sure no part of the form is missing after it is printed. Please also make sure the forms print with the proper number of pages: the Form 1-EZ, Form 1, and Schedule A require two pages each; the Form 1-ES requires one page.

Any vendor requesting approval of automated forms may send a sample to the address in item 9. under "CONTACTS" on p. ii. Include 3 original forms produced by your software and a brief note requesting PBGC review of the forms.

The premium forms are in Optical Character Recognition (OCR) format. This enables PBGC to process your plan information quickly and accurately. The OCR process requires that you print data clearly within the boxes provided on the forms.

Pension Benefit Guaranty Corporation Dept. 77430 P.O. Box 77000 Detroit, MI 48277-0430Do not use this address for any purpose except to mail your premium forms and your premium payment check(s).

PBGC, Bank One 9000 Haggerty Road Dept. 77430, Mail Code MI1-8244 Belleville, MI 48111

Bank One, NA Chicago, IL ABA: 071000013 Account: 656510666 Beneficiary: PBGC Reference: (give plan's EIN/PN and the date the premium payment year commenced(PYC))Report the EIN/PN from item 3(a) and (b) of Form 1-EZ, Form 1, or Form 1-ES and the date the premium payment year commenced (PYC), in the payment ID line of the electronic funds transfer in the format "EIN/PN: XXXXXXXXX/ XXX PYC: MM/DD/YY." Since we process these payments electronically, strict adherence to this format is required for accurate and timely application of your payment. Any deviation from the prescribed format may result in our sending you a bill for premium, interest, and penalty if our automated system cannot apply your payment.

For example, suppose your plan year has been changed by amendment from a calendar year to a year beginning July 15, effective July 15, 2005. Assume that your premium for the plan year beginning January 1, 2005, calculated as if there were no short-year proration, would be $11,400. This is the amount you would enter in item 14 of Form 1-EZ or Form 1 for the plan year beginning January 1, 2005. If you choose to prorate your premium for that year, you would determine your short-year credit by multiplying $11,400 by 5/12. (The number of full and partial months in your short year -- i.e., January through July of 2005 -- is 7, so the numerator of the fraction is 5 -- i.e., 12 minus 7.) This gives you a short-year credit of $4,750 (for the five months of August through December of 2005), which you would enter in item 15(b) of Form 1- EZ or Form 1 for the plan year beginning January 1, 2005. Assuming you have no other credits, you would pay $6,650 (i.e., $11,400 minus $4,750) with the Form 1-EZ or Form 1.

Note -- Counting Months for Proration

Each "plan month" (i.e., each month

in the plan year) generally begins on the same day of each successive

calendar month. For example, if the plan year begins on July 1,

the first day of each successive calendar month is the beginning

of a new plan month; similarly, if the plan year begins on January

15, the second plan month begins on February 15, the third plan

month on March 15, etc. Thus, if a short final year begins on January

1 and ends on June 1, there would be 6 (full or partial) months

in the short year. (The last (partial) month, beginning (and ending)

on June 1, would count as a full month for purposes of prorating

the premium.) Similarly, if a short first year begins on July 31

and ends on December 31, there would also be six (full or partial)

months in the short year.

There are two special rules when a plan year begins at or near the end of a calendar month:

Example 1 A new plan is adopted on December 1, 2005, and has a July 1 - June 30 plan year. The plan became effective for benefit accruals for future service on December 1, 2005. The plan administrator may prorate the 2005 flat-rate premium and pay for only seven months (December 2005 - June 2006). Alternatively, the plan administrator may pay a full year's premium and either (1) claim a credit on the next year's premium filing or (2) request a refund for the period of July - November 2005.

Example 2 By plan amendment adopted on December 1, 2004, a plan changes from a plan year beginning January 1 to a plan year beginning June 1. This results in a short plan year beginning January 1, 2005, and ending May 31, 2005. The plan administrator may prorate the premium for the short plan year and pay for only five months (January - May 2005). Alternatively, the plan administrator may pay a full year's premium and either (1) claim a credit on the next year's premium filing or (2) request a refund for the period of June - December 2005.

Example 3 On October 15, 2005, the plan administrator of a calendar year plan pays the plan's premium for the plan year beginning January 1, 2005. The plan administrator expects a plan amendment to be adopted in November 2005, and made retroactively effective to February 1, 2005, changing from a plan year beginning on January 1 to a plan year beginning on February 1. In determining the premium for the plan year beginning January 1, 2005, the plan administrator may anticipate the adoption of the amendment and prorate the premium for the short plan year, paying for only one month (January 2005). (If the amendment is not adopted, an amended filing would have to be made, and the additional amount of premium owed would be subject to interest and penalty.) Alternatively, the plan administrator may pay a full year's premium and either (1) claim a credit on the next year's premium filing or (2) request a refund for the period of February - December 2005.

Example 4 By plan amendment adopted on June 5, 2005, and made retroactively effective to April 1, 2005, a plan changes from a plan year beginning January 1 to a plan year beginning April 1. The plan has a short year beginning January 1, 2005, and ending March 31, 2005. The plan administrator may prorate the premium for the short plan year and pay for only three months (January - March 2005). Alternatively, the plan administrator may pay a full year's premium and either (1) claim a credit on the next year's premium filing or (2) request a refund for the period of April - December 2005.

Example 5 A calendar year plan terminates in a standard termination with a termination date of September 30, 2004. On April 7, 2005, assets are distributed in satisfaction of all benefit liabilities. The plan has a short plan year ending April 7, 2005. The plan administrator may prorate the 2005 premium and pay for only four months of 2005. Alternatively, the plan administrator may pay a full year's premium and request a refund for the period of May - December 2005.

Example 6 A plan with a plan year beginning July 1 and ending June 30 terminates in a distress termination with a termination date of April 28, 2005. On July 7, 2005, a trustee is appointed to administer the plan under ERISA section 4042. The plan has a short plan year beginning July 1, 2005, and ending July 7, 2005. The 2005 premium may be prorated by taking a credit for 11/12 of the 2005 plan year (for the period of August 2005 - June 2006). Alternatively, a full year's premium may be paid and a refund requested for the period of August 2005 - June 2006.

If you sent in your payment without filing the Form 1-EZ, Form 1, or Form 1-ES, as applicable, send the correct form to the address in item 2.a. or 2.b. under "CONTACTS" on p. ii.

If you sent us Form 1-EZ, Form 1, or Form 1-ES without making a required payment, you should send the payment as soon as possible to minimize late payment charges. If you make your payment by check, enclose your check with a copy of the original form and send them to the address in item 2.a. or 2.b. under "CONTACTS" on p. ii. If you make your payment by electronic funds transfer, make the transfer as described in item 2.d. under "CONTACTS" on p. ii.

Report the EIN/PN from item 3(a) and (b) of Form 1-EZ, Form 1, or Form 1-ES and the date the premium payment year commenced (PYC), in the payment ID line of the electronic funds transfer in the format "EIN/PN: XX-XXXXXXX/XXX PYC: MM/DD/YY."

If you discover after you have filed the 2005 Form 1-EZ or Form 1 that you have made an error in your participant count or in the calculation of the variable-rate premium due, you must use a 2005 form to correct your filing. (Underpayment in an earlier year must be corrected using the form(s) for that specific year. See B.3.e.iii., p. 12, for information on obtaining an earlier year's form(s).) Check the box in the heading of the Form 1-EZ or Form 1 to indicate that this is an amended filing. (On prior years' forms without an "Amended Filing" box, print or type "Amended Filing" at the top of the form.) Fill in the Form 1-EZ or Form 1 and Schedule A as you would for your annual filing. Enter the corrected total premium in item 14 of Form 1-EZ or in item 14(a) or 14(d) of Form 1 (as appropriate). In item 15(b) of Form 1-EZ or Form 1, enter the sum of the credits you previously claimed in that item plus the amount you paid with your original filing. The amount due with the amended filing should appear in item 16 of Form 1-EZ or Form 1. This should equal the difference between the new total premium due and the new total credits. Submit your amended Form 1-EZ or Form 1 (with Schedule A for single-employer plans, even if no Schedule A data have changed) with your payment as described in item 2. under "CONTACTS" on p. ii.

If you discover after you have filed the 2005 Form 1-EZ or Form 1 that you overpaid your premium, follow the instructions in B.6.c. above, except that the difference between the new total premium and the new total credits should be entered in item 17 of Form 1-EZ or Form 1. Also, you must check the box in item 17 if you want this amount refunded.

Send your amended Form 1-EZ or Form 1 (with Schedule A if appropriate) promptly to the address in item 2. under "CONTACTS" on p. ii. If you want your refund paid by electronic funds transfer, you must provide the necessary information in item 17. If you are amending your filing to prorate the premium for the short first plan year of a newly created plan that is adopted with a retroactive effective date, make sure that the date used as the first day of the premium payment year for purposes of proration is the same as the premium snapshot date.

Note: If the overpayment shown on an amended filing (for any year) exceeds $500, attach a statement explaining the specific circumstances or events that caused the overpayment and made the amended filing necessary. (For example, if your original filing's participant count included employees at a division that is not covered by the plan, the statement would explain why the employees were erroneously counted as participants and how the error was discovered.) Check the box in item 19 on Form 1-EZ or item 18 on Form 1 to indicate that the statement is attached.

See items 1 and 2 of Part C (p. 19) or Part D (p. 26) if you need to correct your address or the plan sponsor's address and are doing so at the same time you are making your premium filing.

However, to keep our records current and to ensure that your forms will be mailed to the correct address, you should provide us with your current address as soon as a change has occurred. You may do so by contacting us either in writing or by phone as described in item 3. under "CONTACTS" on p. ii.

If you file a premium payment after the Filing Due Date, we will bill the plan for the appropriate Late Payment Charges. The charges include both interest and penalty charges. The charges are based on the outstanding premium amount due on the Filing Due Date. (PBGC also may assess penalties under section 4071 of ERISA for failure to provide premium-related information (see B.8., p. 18).)

The Late Payment Interest Charge is set by ERISA and we cannot waive it. Interest accrues at the rate imposed under section 6601(a) of the Code (the rate for late payment of taxes) and is compounded daily. The rate is established periodically (currently on a quarterly basis) and the PBGC publishes the interest rates on or about the 15th of January, April, July, and October in the Federal Register. The rates are also posted on the PBGC's website (www.pbgc.gov).

Late Payment Interest Charges will be assessed for any premium amount not paid when due, whether because of an estimated participant count or an erroneous participant count or other mistake in computing the premium owed.

The Late Payment Penalty Charge is established by us, subject to ERISA's restriction that the penalty not exceed 100 percent of the unpaid premium amount. The penalty is a percentage of the unpaid amount for each month (or portion of a month) it remains unpaid. The monthly rate is higher or lower depending on whether the premium underpayment is "self-corrected." The penalty rate is 1 percent of the late premium payment per month if the late payment is made on or before the date when the PBGC issues a written notification indicating that there is or may be a premium delinquency (e.g., a statement of account (premium invoice), a past-due-filing notice, or a letter initiating an audit). A penalty rate of 5 percent per month applies to payments made after the PBGC notification date.

Before the Filing Due Date, if you can show substantial hardship and that you will be able to pay the premium within 60 days after the Filing Due Date, you may request that we waive the Late Payment Penalty Charge. If we grant your request, we will waive the Late Payment Penalty Charge for up to 60 days.

To request a waiver, write separately to the address in item 3.a. or 3.b. under "CONTACTS" on p. ii.

Waivers of the Late Payment Penalty Charge may also be granted based on any other demonstration of reasonable cause. If you wish to request such a waiver, write to the address in item 3.a. or 3.b. under "CONTACTS" on p. ii after you receive a statement of account (premium invoice) assessing penalties. This address should also be used to submit requests for reconsideration of late payment penalties. Failure to obtain premium forms and instructions from the PBGC is not reasonable cause for a waiver.

If you are having difficulty determining your plan's premium before the Final Filing Due Date, you can file your premium forms using an estimate. You can then make an amended filing, reflecting the actual figure (see B.6., p. 15, for procedure). This will minimize the assessment of Late Payment Charges to the plan.

The premium owed for a plan year is based on the number of plan participants as of the premium snapshot date. However, plans may not have an accurate participant count before the First Filing Due Date. For this reason, the Form 1-ES permits plans to compute the amount owed on the basis of an estimated participant count. However, we remind you that for plans required to pay premiums for 500 or more participants for the prior plan year, the total flat-rate premium, in the case of a single-employer plan, or the entire premium, in the case of a multiemployer plan, is due by the First Filing Due Date. If the full amount due is not paid by that date, the plan will be subject to late payment interest charges and may also be subject to late payment penalty charges.

No penalty will be charged (although interest will be charged) if you did not make an estimated premium payment because you erroneously reported fewer than 500 participants for the plan year preceding the premium payment year. In addition, you can avoid a late payment penalty charge (but not the interest) for the flat-rate premium if the premium (based on an estimated participant count) that you pay with the Form 1-ES by the First Filing Due Date equals at least the lesser of:

For purposes of determining whether a penalty is due, the participant count "erroneously reported" refers to the premium filing (or last amended filing) for the plan year preceding the premium payment year made to the PBGC by the First Filing Due Date.

See the Form 1-ES instructions in the Estimated Premium Payment Package for more detail. If you have an accurate participant count by the First Filing Due Date, you should pay the amount owed by that date. If you do so, you will avoid the interest charge and any penalty charge. If you have all the information needed to make a final filing on or before the First Filing Due Date, you may file a Form 1-EZ or Form 1 (with Schedule A for a single-employer plan). If you file a Form 1-ES, you will still be required to file a Form 1-EZ or Form 1 (with Schedule A for a single-employer plan) by the Final Filing Due Date.

If a premium is overpaid for a plan, you may request that the overpayment be refunded or applied to the next year's premium for the pla.

If you request that an overpayment be applied to the next year's premium, you should claim the amount of the overpayment as a credit on the next year's premium filing for the plan.

A request for a refund must be made within the period specified in the applicable statute of limitations (generally six years after the overpayment was made). If there are unpaid premiums, interest, or penalties for your plan for prior years, you may request the PBGC to apply all or part of an overpayment toward payment of those unpaid prior year amounts.

If you request payment of a refund by electronic funds transfer, we will make the transfer through the automated clearing house (ACH) system.

Please note that ERISA does not provide for us to pay interest on premium overpayments.